Excitement About Amur Capital Management Corporation

Excitement About Amur Capital Management Corporation

Blog Article

Amur Capital Management Corporation Things To Know Before You Buy

Table of ContentsGetting The Amur Capital Management Corporation To WorkThe 10-Minute Rule for Amur Capital Management CorporationSee This Report on Amur Capital Management CorporationUnknown Facts About Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals ExplainedOur Amur Capital Management Corporation PDFsWhat Does Amur Capital Management Corporation Mean?

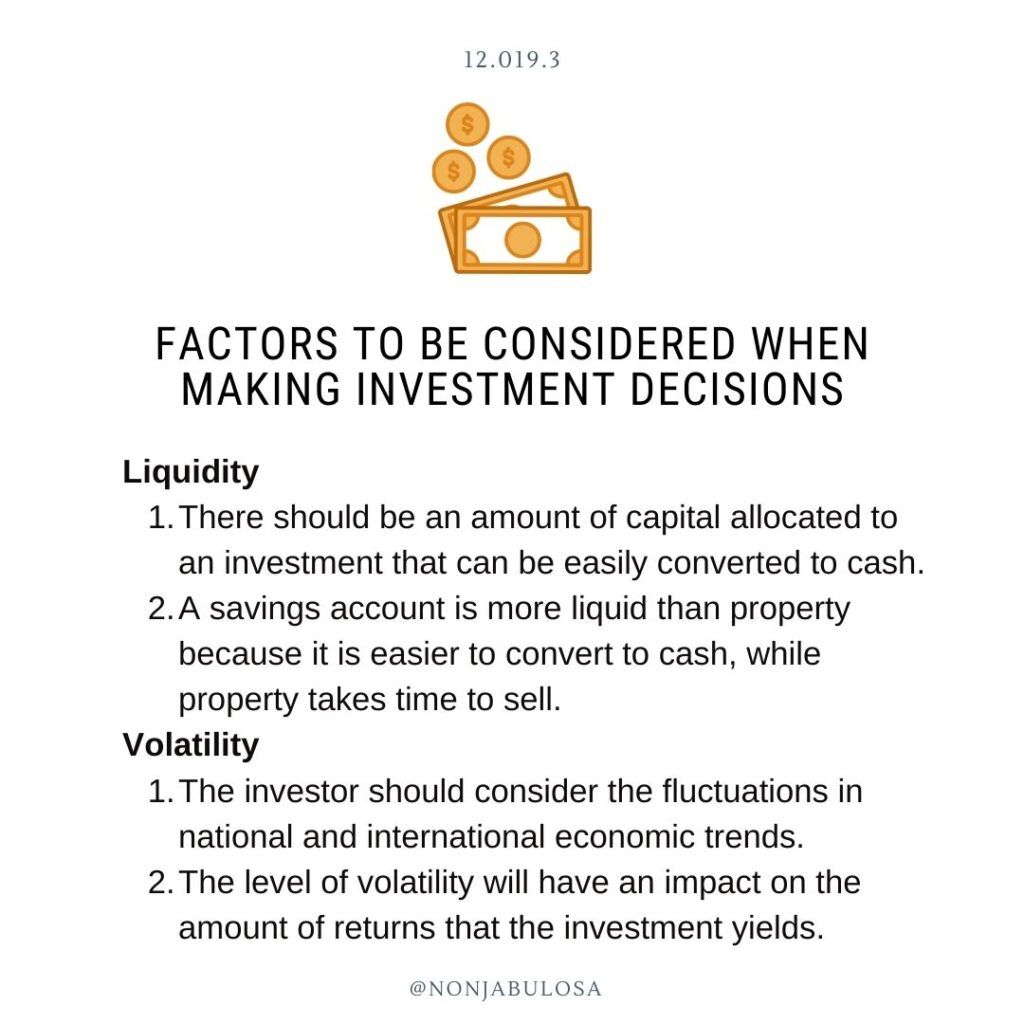

worth appreciation Finances are convenient, but they may come at a huge expense. You dedicate your future revenue to obtain energy today at the price of rate of interest spread throughout several years. Make sure you comprehend exactly how to manage financings of this nature and prevent high degrees of debt or what they call over-leverage.

An Unbiased View of Amur Capital Management Corporation

Threats consist of delays, raised costs, and the unknowns of a newly-developed neighborhood. Existing properties provide comfort, much faster accessibility, developed improvements (utilities, landscaping, etc), and in lots of instances, reduced costs.

Evaluation residential property acts, recent studies, and assessment records for existing residential properties. Take into consideration month-to-month upkeep prices, superior dues, and taxes. Costs such as these can significantly affect your capital. When investing in rented building, learn if the building is rent-controlled, rent-stabilized, or free enterprise. Is the lease about to expire? Are revival alternatives beneficial to the renter? That owns the home furnishings? Quality-check products (furniture, fixtures, and devices) if these are to be included in the sale.

Indicators on Amur Capital Management Corporation You Need To Know

If needed, deal with boosting your credit scores rating: Pay bills on timeset up automated payments or remindersPay down debtAim for no more than 30% credit report utilizationDon't close unused credit cardsas long as you're not paying annual feesLimit requests for brand-new credit and "difficult" inquiriesReview your debt record and dispute mistakes Just like other sorts of financial investments, it's good to purchase low and offer high.

Everything about Amur Capital Management Corporation

It's also essential to pay attention to home mortgage prices so you can decrease your funding costs, if possible. Keep current with patterns and data for: Home costs and home sales (general and in your desired market)Brand-new constructionProperty inventoryMortgage ratesFlipping activityForeclosures Real estate can assist diversify your profile (mortgage investment corporation).

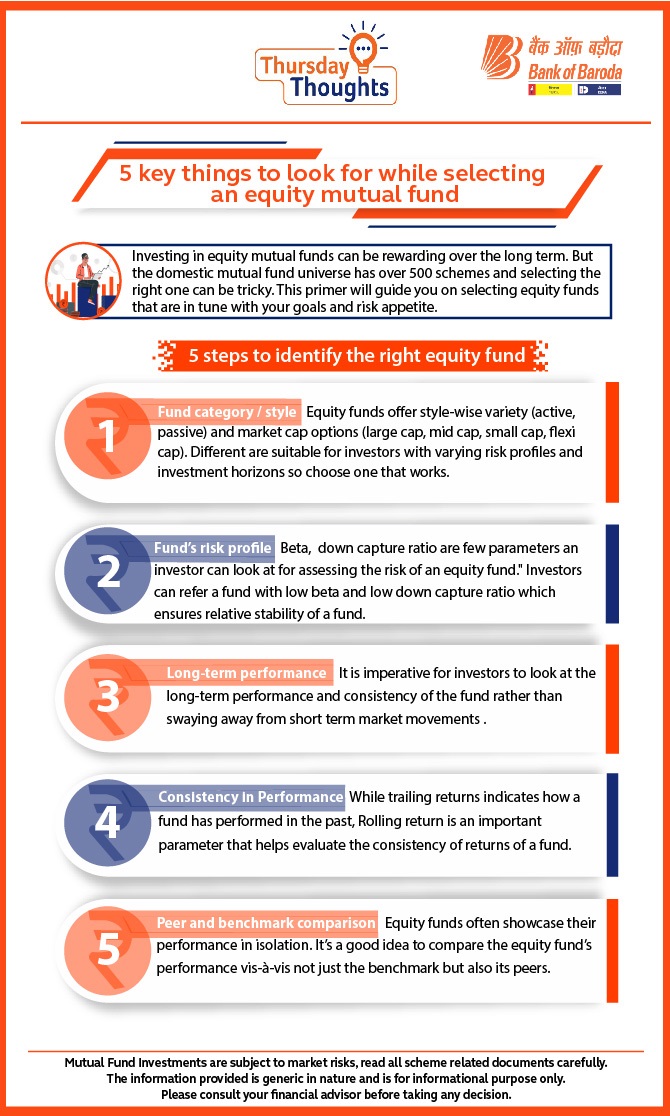

Of program, simply like any financial investment, it is essential to think about particular variables, like the ones noted here, prior to you purchase genuine estatewhether you select physical residential or commercial property, REITs, or another thing. (https://www.kickstarter.com/profile/amurcapitalmc/about)

We have a sneaking suspicion you already understand what investing is, however simply in case, allow's specify spending terms. After that we'll inform you just how to do it. Investing includes dedicating money in order to earn an economic return. This basically indicates that you spend cash to earn money and accomplish your monetary goals.

Examine This Report about Amur Capital Management Corporation

Despite where you invest your cash, you're essentially offering your money to a company, federal government, or other entity in the hope they give you with more money in the future. People usually invest cash with a particular goal in mind retirement, their youngsters's education, a house, and so on. Investing is various from conserving or trading. Typically spending is linked with placing money away for a lengthy period pop over here of time instead of trading stocks on a more normal basis.

Cost savings are sometimes assured but financial investments are not. If you were to keep your money under the bed mattress and not spend you 'd never have even more cash than what you've done away with on your own. That's why numerous individuals pick to spend their cash. There are numerous points you can place cash right into.

The Single Strategy To Use For Amur Capital Management Corporation

Let's hold for a 2nd and figure out if you need to be investing in the initial place. Prior to you start spending in anything, you should ask on your own a couple crucial questions.

Layoffs, all-natural catastrophes, healths issues let us count the methods which your life can be transformed upside down. Any kind of economic advisor will tell you that to avoid total destroy you need to have in between 6 months and a year of total living costs in money, or in a financial savings account need to the unimaginable occur.

Not known Factual Statements About Amur Capital Management Corporation

Before we go over the specifics of what you should consider purchasing, be it supplies, bonds, or your cousin Brian's yak ranch allowed's initially review the basics of exactly how one invests. Investing is what takes place when at the end of the month, after the expenses are paid, you've got a couple of dollars left over to put towards your future.

In all possibility, you'll earn extra in your thirties than you did in your twenties, and even much more than that in your forties. If you have not heard of this prior to, let us discuss.

Report this page